In an earlier Devpolicy blog post, ten criteria were set out for judging the success of PNG’s 2015 Budget. This post makes an assessment against those criteria. A preliminary budget analysiswas released the day after the budget. Readers are invited to make their judgement on the credibility of the Government’s financial plans – this is the key unknown in the budget. Given the growing economic problems facing PNG (foreign exchange controls hurting businesses, printing money possibly starting inflationary pressures) getting fiscal policy right in this budget was absolutely vital for PNG’s future. If you think cuts of 25% in real terms are possible over the next two years leading up to the 2017 election, you may decide to give it a “C”. If you think that expenditure cannot (or should not) be cut by this amount, then readers may decide to give it an “E”. For this writer, despite much that is good in this budget, the medium-term fiscal plans are neither credible nor appropriate. It scores an “E” as it is a significant further step down a slippery economic slope, which will hurt the poor of PNG.

In an earlier Devpolicy blog post, ten criteria were set out for judging the success of PNG’s 2015 Budget. This post makes an assessment against those criteria. A preliminary budget analysiswas released the day after the budget. Readers are invited to make their judgement on the credibility of the Government’s financial plans – this is the key unknown in the budget. Given the growing economic problems facing PNG (foreign exchange controls hurting businesses, printing money possibly starting inflationary pressures) getting fiscal policy right in this budget was absolutely vital for PNG’s future. If you think cuts of 25% in real terms are possible over the next two years leading up to the 2017 election, you may decide to give it a “C”. If you think that expenditure cannot (or should not) be cut by this amount, then readers may decide to give it an “E”. For this writer, despite much that is good in this budget, the medium-term fiscal plans are neither credible nor appropriate. It scores an “E” as it is a significant further step down a slippery economic slope, which will hurt the poor of PNG.

1. Have the right expenditure priorities been chosen? B

Fundamentally, the Government remains on track in terms of ensuring the highest priority areas of education, health, infrastructure and law and order receive increased levels of funding. However, within these positive aggregate allocations, the devil is in the implementation detail. Particularly for this budget, the major new initiative of K445m in education and health infrastructure programs at the district level lacks the performance information required to justify such an allocation. The escalating cost of holding the 2015 South Pacific Games is of concern (and the costs of the 2018 APEC meeting a looming worry on expenditure priorities).

2. Is a sustainable fiscal policy set out? D, E or F

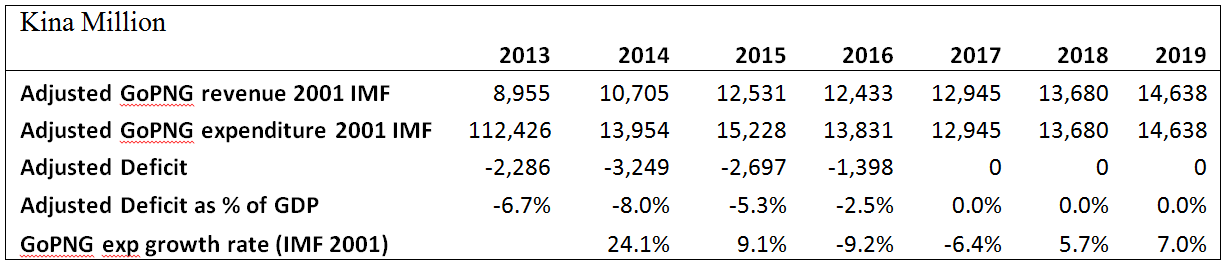

Understanding this key issue involves examining the budget using more modern and transparent government accounting statistics. PNG has agreed to move away from the outdated 1986 IMF standards and to adopt the internationally agreed 2001 Government Financial Statistics standard (indeed, some countries are moving to an even more modern standard). The key changes for budget reporting are that expenditures are shown when the funds are actually spent (so the supplementary budget is split into the actual year of expenditure, not just when deposited into a trust account), revenues are shown when received (so the apparently permanent bring forward in dividends is backed out) and certain savings measures are not recognised (the K444m reallocation from departmental trust accounts is not a saving – it is a form of non-debt financing under the 2001 standards). So what does this technical change mean in practice? This is set out in the table below. Two key changes. First, the deficits in both 2014 and 2015 are larger than reported – highlighting the real fiscal challenges facing the government. Rather than reducing the deficit from 2013 to 2014, the deficit looks likely to increase to a very high 8.0% of GDP – much higher than the claimed 5.9%. The 2015 deficit is now looking to be 5.3% of GDP – also much higher than the 1.1% initially set out in the government’s medium-term fiscal strategy two years ago. The second impact of these adjustments is that 2014 is an extraordinary year for expenditure growth – over 24%! Building on this much higher level of expenditure, the 2015 budget still grows another 9%. No wonder there are difficulties in financing the deficit. So the ranking on this criteria is at best a “D”.

However, the out years paint an even more frightening picture. To get back to surplus by 2017, expenditure cuts of 9.2% are projected for 2016 and a further cut of 6.4% in 2017. And this ignores the impacts of inflation – so the cuts in real terms are over 14% and then 11% – a combined real cut of 25%. Realistically, where will these cuts come from? Do we really believe the budget documents stating the education sector budget will be reduced from K1,909m in 2015 to only K1,575m by 2017? Or the health sector budget from K1,771m to K1,372m? Or the economic sector (such as agriculture and SMEs) from K730m to K438m? Often the best way to predict future actions is to observe past actions. The Government has not demonstrated a willingness to cut budgets in such a way (and nor should cuts of this order of magnitude be considered).

However, the out years paint an even more frightening picture. To get back to surplus by 2017, expenditure cuts of 9.2% are projected for 2016 and a further cut of 6.4% in 2017. And this ignores the impacts of inflation – so the cuts in real terms are over 14% and then 11% – a combined real cut of 25%. Realistically, where will these cuts come from? Do we really believe the budget documents stating the education sector budget will be reduced from K1,909m in 2015 to only K1,575m by 2017? Or the health sector budget from K1,771m to K1,372m? Or the economic sector (such as agriculture and SMEs) from K730m to K438m? Often the best way to predict future actions is to observe past actions. The Government has not demonstrated a willingness to cut budgets in such a way (and nor should cuts of this order of magnitude be considered).

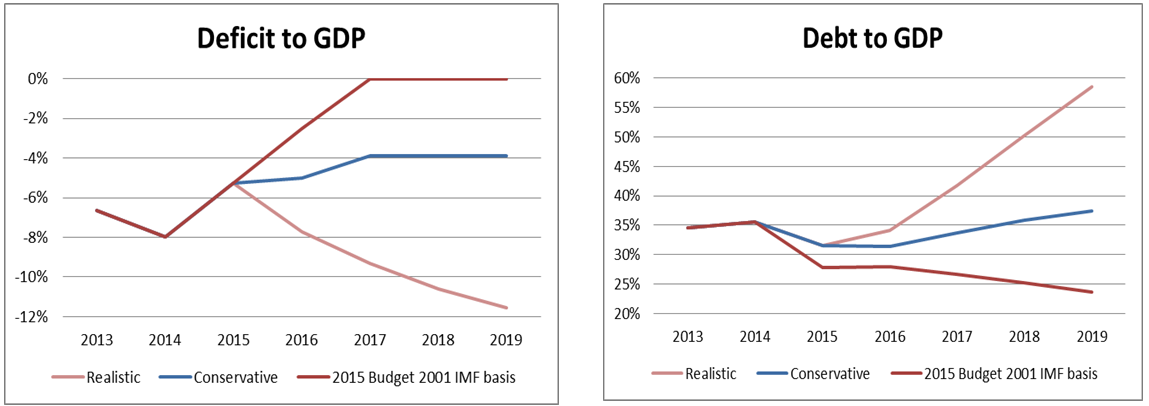

But what happens if they don’t cut the budget? The graph below shows three possible projections for expenditure in the out years and the way they impact on deficit to GDP as well as debt to GDP levels. Based on the 2015 budget numbers, if there is a 25% real cut, the budget returns to surplus and debt stays below 30% of GDP. If there is a very ‘conservative’ scenario of expenditure being continued at 2015 levels in 2016 and 2017 (no allowance made for inflation) and then grows at the budgeted levels, then the deficit is 3.9% in 2019 and debt to GDP has increased to 37.5%. The third line shows a more ‘realistic’ pattern of expenditure increases of 10% in nominal terms (about 1% in real per capita terms). By 2019, PNG is well and truly on the way to an economic crisis. Deficits have grown to over 11% of GDP, and the debt to GDP ratio of 58.5% is nearly double the Financial Responsibility Act limit of 30%. Interest payments have climbed to over K3.5 billion per annum and account for 16% of total expenditure (up from 4.3% in 2013). The ‘realistic’ scenario would be disastrous for PNG, and deserves an “F” rating. More action is required in 2014 and 2015 to make fiscal policy sustainable.

Underlying data available here [pdf].

Underlying data available here [pdf].

3. Is the deficit financing strategy appropriate? C or E

PNG has not been able to raise sufficient funds to finance the 2014 deficit from domestic markets. Under-subscriptions on government debt means the central bank (BPNG) has started printing money to cover the deficits leading to a significant risk of higher rates of inflation. The almost magical answer for this problem is an assumed $2.5 billion in funds from asset sales. This is from a possible sale of part of the PNG LNG project to landowners. It is not clear if such a sale can be put in place in 2015 – even local accounting firms have reservations about this being possible and indicate only half the sale is allocated to debt reduction. The valuation for such a sale is also very large – the 2014 budget had the sale listed as being worth K600m (and so this is the figure that has been included in the ‘conservative’ and ‘realistic’ debt analysis above). Possibly other asset sales are planned. As long as competition policy is given sufficient focus when selling natural monopolies, this is appropriate. But nothing is mapped out in the budget to this effect. Essentially, the budget places most of its eggs in this one basket of asset sales of part of the PNG LNG project without providing convincing information as to its value or its timing. Interest costs also appear significantly underestimated as the rollover of government debt will need to be financed at interest rates which have nearly doubled since the last budget. So if one considers that the K2.5 billion in asset sales will proceed, overall a ranking of “C”. If asset sales in 2015 of K600m are judged as more realistic this is an “E”.

4. Is the budget structure supporting good development? C

One of the highlights of the budget is the continued aspiration to move towards a much more modern framework of integrated, multi-year budgets. There are clearly some teething problems – this process will take around five years realistically – but there is progress in this budget on a technical side. There also appears to be a shift towards meeting recurrent expenditures rather than simply building new infrastructure (although much of this is driven by K558m extra in interest costs in 2015). However, the purpose of multi-year budgeting is to set out realistic budget envelopes so that agencies can plan future expenditures. As noted above, after 2015, the budget figures are not credible and fundamentally undermine good planning.

5. Is the budget sufficiently transparent? C

PNG continues to produce a budget filled with good information. However, PNG should move from the 1986 to the 2001 accounting standards to better understand what is going on in the budget. The loss of detailed information on the value of individual state-owned enterprises is a step backwards and adds to the issue below of K3.3 billion in mineral revenue simply disappearing from the budget books with little explanation. There is still no integration of budget information across the national, provincial and district levels (this used to be provided in the budget).

6. Is there enough accountability for performance? D

There is a dearth of performance information on major new programs such as the Services Improvement Programs. These have been the largest funding initiative of this government but little information is provided. Better project planning processes are outlined and hopefully these will help provide better decisions and information in future years.

7. How will assets be treated, including updates on the sovereign wealth fund (SWF) and Kumul arrangements and their impacts on revenues? D

There is good new information included on the flow of funds into and out of the proposed Stabilisation and Savings Funds of the SWF. Some of this may require technical clarification but is a positive step forward and would rate as B+. However, there is almost no information provided on the Kumul arrangements. Digging into the numbers produces a very worrying story. From 2016 to 2018, using the 2014 budget as a base, it appears that 60% of all PNG LNG/mining dividends disappears (K1,646m) as does 25% of all mining and petroleum taxes (K1,708m). It is extremely worrying that over K3.3 billion is no longer flowing through the budget to support development. The SWF may be established, but its purpose is undermined by such a diversion of revenue. Presumably these funds will cover the costs of items such as the UBS loan for the Oil Search shares purchased in March, as well as other possible Kumul Holdings adventures such as financing any new stage of Ok Tedi which, using 1986 standards, are treated as off-budget expenditures. No information is provided on how funds will be obtained for recent adverse court rulings on the IPIC loan and Nautilus.

8. Are there revenue policy improvements flowing from the Tax Review? No rating

The budget indicates that the 2016 budget will consider findings from the tax review headed by Sir Nagora Bogan. This process seems to be going very well. Given the budget difficulties outlined above, serious consideration needs to be given to a tax mix switch that also lifts the overall level of taxation.

9. Is there needed action on public sector reform? D

No action has been taken on the proposals in the last two budgets for reducing public sector duplication through amalgamating agencies. Rather than doing, another review has been set up. Action on previous decisions would speak louder than setting up another review committee.

10. Overall, is this a credible budget? E

The 2015 Budget has a narrative of fiscal responsibility. The loyal public servants that would have worked extraordinary hours to produce the government’s key annual policy document are to be commended. However, the budget is ultimately a political document and the Treasurer, on behalf of the Government, is the actual author. Assumptions about future year expenditure levels or the level of asset sales or the diversions away from the budget are decisions of the government. There are serious doubts about whether the budget supports its claim of being fiscally responsible. Not enough information on the K2.5 billion in asset sales or the K3.3 billion of diverted minerals revenues are presented. The proposed expenditure levels in future years are not credible.

It is fundamentally for this last critical reason of credibility that this author gives the 2015 budget a disappointing rating of an “E”. I had hoped for more, given PNG’s economic challenges. Ultimately, it will be for others to make a judgement and readers have been invited to do so above. International investors will make their judgements. The financial rating agencies will make their judgements. And ultimately, the people of PNG will make their judgement.

Paul Flanagan is a Visiting Fellow at the Development Policy Centre, ANU. He was formerly a senior executive in the Australian Treasury, and went on secondment as an advisor to the PNG Treasury from 2011 to 2013.

The government is spending millions of kina on unnecessary activities that are not actually helping the total population of the country. The government should be careful on the spending and save some money for the future. The government misappropriation leads to inflation and increase in school fees, taxes, rents, etc.

Great Story!!!

Thank you!