Executive Summary

Do the controversial conclusions of the “Double or Nothing: The Broken Economic Promises of the PNG LNG project” report still hold? The broad answer is “Yes” – indeed the conclusions are re-enforced by recent economic data. Fortunately, PNG’s new Marape/Steven government is seeking better terms for future projects. It is too early to tell if it will make even more important but politically difficult policy changes to reverse the “resource curse” approaches of the O’Neill government.

- Recent PNG National Statistics Office figures have confirmed that PNG Treasury was over-estimating the health of the PNG economy in 2016. The new figures increase the gap between PNG LNG promises and actual outcomes relative to “business as usual” prior to the PNG LNG project (see “statistical details” section below for detail).

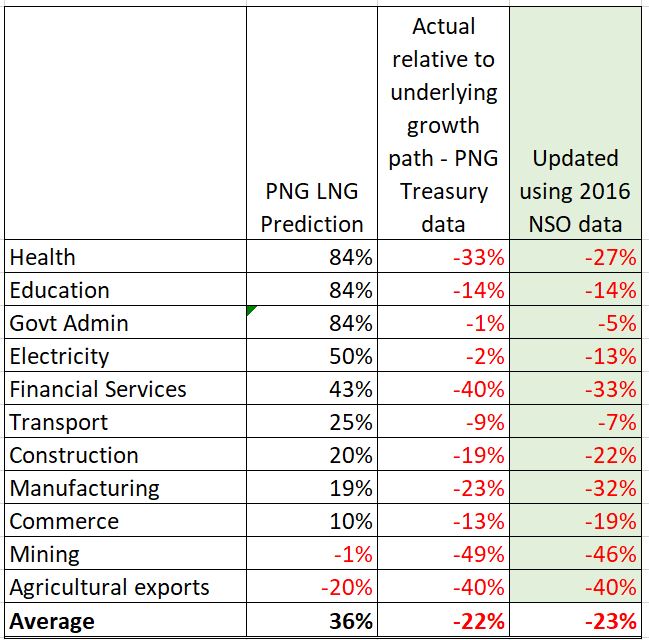

- At a more detailed sectoral level, there is a mixed story with sectors such as health not doing as badly as thought (now ‘only’ minus 27%) but manufacturing doing worse (now minus 32%). The average outcome remains that PNG’s industries were just over one-fifth worse off in 2016 than if they had simply continued the “business as usual” growth prior to the PNG LNG project.

- Overall, the PNG LNG project massively over-promised and then failed to deliver. This is not because of the fall in oil prices – indeed LNG export returns are higher than predicted.

- Resource projects on good terms should be good for development – but this requires good policies. The PNG LNG project induced poor policies under the O’Neill government. These poor policies have overwhelmed the potential PNG LNG benefits.

- The O’Neill government made little progress on the four recommendations from the report designed to address the broken promises of the PNG LNG project (see below). This probably contributed to its fall.

- There are encouraging signs that the new Marape/Steven government is seeking better returns from its resources. Hopefully, it will also pursue better policies in other policy areas such as competition policy and devaluing the exchange rate to deal with the resource curse. But these will be politically difficult.

Details

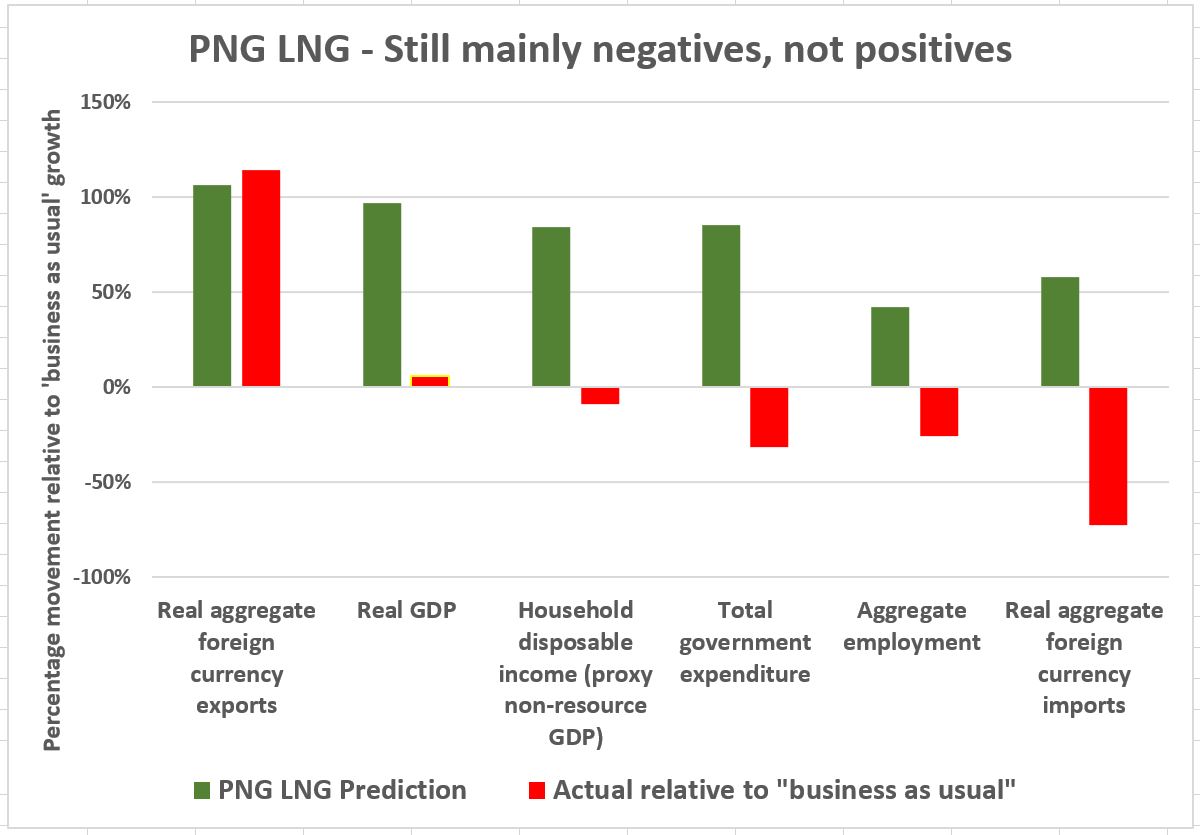

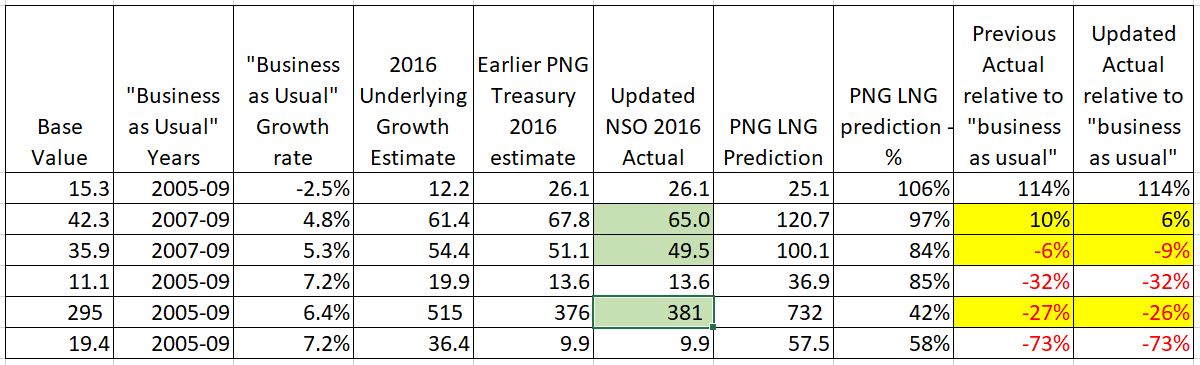

The release of national accounts information by the NSO in April shows lower GDP and non-resource GDP (a proxy for household incomes) in 2016 relative to the PNG Treasury forecasts used in the earlier analysis. This has the effect of increasing the gaps between the PNG LNG modelling predictions, and actual outcomes. Specifically, the PNG LNG modelling had projected an increase in GDP of 97% two years after production had commenced. The actual outcome relative to the pre-PNG LNG “business as usual” case was a 6% increase – down from 10% in the initial report. For household disposable income, the prediction was an 84% improvement. The outcome is a decline of 9%, larger than the decline of 6% estimated in the earlier report. Using updated Bank of PNG figures on employment, the prediction was an increase of 42%. The outcome is now estimated as a fall of 26%, slightly smaller than the 27% decline in the earlier report. There is no new data on exports, imports and government expenditure.

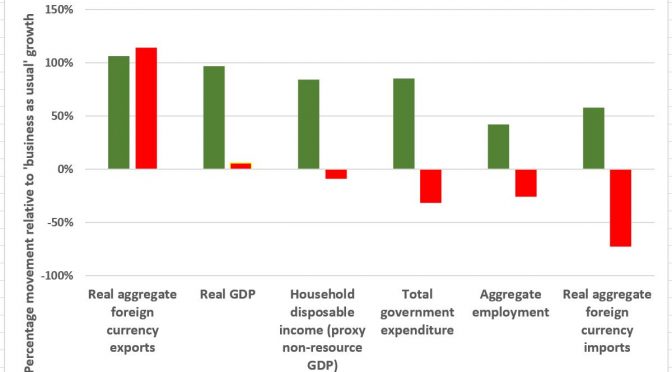

The following graph updates that on page 6 of the Executive Summary of the initial “Double or Nothing” report. It contrasts PNG LNG predictions with actuals all relative to the pre-PNG LNG undergrowing growth path (or ‘business as usual’ growth case which was running at 5% growth per annum).

Of course, many people have benefited from the PNG LNG project such as local transport, catering and security firms, the support for local health and education facilities, the work of project partners in responding to the 2015 drought and 2018 earthquake, some tax and dividend revenues, and some landowner benefit payments (although see a related Jubilee Australia report “On Shaky Ground” (see here) which discusses some adverse local impacts and broken promises at the local level). However, taking a helicopter view of the entire economy, household incomes, government expenditures, employment and import levels were worse by 2016 than if the pre-PNG LNG underlying ‘business as usual’ growth trends had continued.

The reasons for failing to deliver had nothing to do with the fall in oil prices in late 2014 – see here (although a continuation of historically high oil prices would have helped). Indeed, as shown by the first columns in the above graph, the PNG LNG project is actually earning more in export incomes than initially projected. The reasons for failure are linked to the O’Neill government’s policy shortcomings in not addressing the well-known “resource curse” risks of a major resource project:

- a 50% build-up in spending before revenues flowed that has led to the largest on-going budget deficits in PNG’s history;

- crippling foreign exchange shortages due to poor exchange rate policies;

- a failure to put enough policy effort into other critical sectors of the economy;

- unwise state investments such as the Oil Search purchase funded by the UBS loan; and

- growing corruption.

As documented in Chapter 5 of the earlier report, the O’Neill government continued to ignore local and international warnings that PNG LNG required appropriate policies to manage the possible adverse impacts on other parts of the economy once the construction phase was completed. PNG slid into classic resource curse policies. Indeed, those making such warnings were often attacked – a classic case being when Isaac Lupari accused me of being unprofessional and working for former Treasurer Don Polye when all I did was to correctly claim that the fall in oil prices in late 2014 would affect 2015 budget revenues. His claims that PNG would largely be sheltered from such falls was false as was his claim that I was still working for Don Polye (although I admired Don Polye including for his stand on the UBS loan and I did work for Polye as a public servant when he was Treasurer). If such warnings had been listened to, the O’Neill government could have made a more rapid fiscal response which would have lessened PNG’s current debt burden.

The “Double or Nothing” report was condemned as “utter nonsense” by former Prime Minister O’Neill (even though he subsequently admitted to the press that he hadn’t read it). Oil Search CEO Peter Botten promised to subject the report to “rigorous analysis” by an independent accounting firm to “demonstrate that there are some serious flaws in the Jubilee report” (see AFR report here). This was not done, or at least the findings have not been released over the last year. Fortunately, former Treasurer Charles Abel did acknowledge that project returns were indeed below par. More recently, the Papua LNG project partners have been more cautious in selling the latest project and we do not have the black magic PNG-GEM model making more overly-optimistic promises. However, the PNG public still does not have access to the economic modelling behind such key claims that the Papua LNG fiscal agreement “divides the net free cash flow 50/50 between PNG and Total led developers”. More transparency is required.

It is encouraging that the new government appears to be taking a more balanced approach towards the resource sector and its potential contribution for inclusive development. Prime Minister Marape’s discusses PNG’s resources as going beyond minerals and gas to agriculture, forestry, fisheries and human resources. Given his strong legal background, including as a former Attorney General, appointing Kerenga Kua as the new Petroleum Minister should help address local concerns about current and prospective LNG agreements.

There is also positive language on gauging views on what needs to be done to create a healthy economy even if it means he doesn’t make many friends (see here). The strong stance on corruption is welcome. However, some policy corrections to move away from the resource curse will be extremely challenging politically. For example, PNG has an over-valued exchange rate which acts as a subsidy on all imports and a tax on all exports. It reduces incomes for rural households yet lowers the cost of living especially in urban areas (the latter because more consumption is imported). However, urban elites appear to have a stronger voice in PNG than the much more numerous rural poor. PNG has also moved away from competition and trade policies that would balance the resource sector and allow PNG to benefit from its strategic location in the Indo-Pacific region. Policies such as high tariffs to protect local manufacturing are understandable but economic history shows the costs for the many outweigh the benefits for the few. These are two examples of the vexed political economy challenges facing the new government. Addressing such policies are critical to addressing PNG’s resource curse. They are at least of equal importance as getting a better direct benefit return from resource projects. Time will tell if the new government will tackle such difficult political economy challenges, challenges that must be addressed to make PNG a much richer black Christian nation.

My next article will explore the different economic impacts of the construction phase and the production phase of large resource projects. The dramatically different economic impacts across these two phases could help explain why former Prime Minister O’Neill wanted to push through the Papua LNG project against the advice of his local team.

Recommendations Re-visited

The “Double or Nothing” report included four recommendations for the PNG government. One year on, how have they gone? Following are the four recommendations, with some comments on progress shown in italics.

1. PNG should return to more inclusive development policies while better managing the resource curse. There is a need to address the overvalued exchange rate, ensure the new medium-term fiscal plans are implemented in a transparent fashion, and re-design the SWF to ensure all resource revenues flow to the budget.

As noted above, there are some positive messages that the new government may consider action in such policy areas. Over the previous year, there had been no improvement in managing the exchange rate (the sovereign bond did not address the underlying issues), the medium-term fiscal plans faced major inconsistencies between the 2019 Budget Strategy and the actual 2019 Budget, and there was little progress on the SWF (which needs to be redesigned anyway).

2. PNG should establish a clear policy framework for all future resource projects (and extensions) that ensures PNG gets a better and earlier share of the resource pie than current agreements. No new resource projects should be approved until this framework is completed and publicly released.

This was not adequately done prior to the Papua LNG agreement. While the new deal has improved some elements of the PNG LNG deal, there clearly was a lack of internal agreement as to whether enough extra had been gained.

3. Projects should not be approved without the production and release of transparent, verifiable, contestable and independent economic modelling by the government; this modelling should include a completely new independent model that includes net costs to the budget.

Fortunately, there was little PNG-GEM spruiking of the new Papua LNG project. However, it did appear to be making claims of future revenues as well as benefit sharing that were not verified by transparent figures or modelling.

4. PNG should urgently clarify some of the confusing figures in the most recent EITI reports that royalties and development levies paid by ExxonMobil are not being received, and explanations provided as to why the level of what should be identical payments are so different.

EITI continues to do a good job in PNG given data limits. However, key information such as the Kumul Petroleum Holdings annual accounts have not been released. Recent data indicates that PNG Treasury had been claiming as “dividend revenues” funds that were actually just “advances” financed by loans from BSP.

Overall, progress against the four recommendations had been poor. That said, it is quite possible that the original report helped confirm and strengthen views in PNG that future projects needed considerably better deals. As stated a year ago “As the government considers this report, there are potential benefits for PNG in terms of encouraging public discussion about PNG’s future options and even supporting PNG’s negotiating hand with the LNG companies. Hopefully, with the benefit of hindsight, “fake news” comments will fade and true benefits will be understood.” Given developments over the last month, possibly the O’Neill government didn’t deal adequately with the broken promises of the PNG LNG. The new government appears committed to not repeating that mistake in terms of benefit sharing. Time will tell if it will also address the crucial underlying “resource curse” policy issues.

Statistical background

The PNG National Statistics Office released updated national account figures for the PNG economy on April 10 2019. This release included detailed figures for 2015 and 2016. The new numbers would be more robust that the earlier PNG Treasury estimates, although they are likely to still be too high (see here). The release also provided consistent figures for 2006, but these did not include new growth rate figures for 2006. If it had, this would have allowed a re-estimation of underlying growth rates which had been based on the three years growth rates for 2007 to 2009. Given that 2008 was actually a year of recession according to the NSO (with growth falling by 0.3%) the inclusion of 2006 information is likely to have lifted the estimate of “business as usual” real GDP growth to slightly above 1.7% per annum in per capita terms, or 4.8% without taking population factors into account. More detailed justification around the “business as usual” growth rates are provided here. The next article will also provide some sensitivity analysis around “business as usual” growth rates.

Using the same methodology as outlined in appendix 2 of the earlier report, three actual 2016 values are updated (shown in green in the following table). These lead to three updated figures for the difference between what the 2016 value would have expected to be if “business as usual” pre-PNG LNG situation continued and the actual 2016 value.

The updated story at the sectoral level also produces slightly worse outcomes. The following table sets out the expected sectoral impacts from the PNG LNG modelling in the second column. The third column covers the gap between the underlying sectoral ‘business as usual’ growth path and the available PNG Treasury figures for 2016. The fourth column uses the recently released 2016 NSO data (except for agriculture exports which continues to use BPNG data). Some sectors have not done as badly as set out in the initial report. For example, the health sector has “only” declined by 27% when the original estimate was a decline of 33%. Other sectors have done worse. For example, the manufacturing sector has declined by 32% rather than the initial estimate of a decline of 23%. The overwhelming story remains – all sectors in the PNG economy outside of the petroleum and LNG sector have gone backwards relative to their underlying ‘business as usual’ growth performance prior to the PNG LNG project. The average decline is now 23%. This is an extraordinary missed opportunity with poor policies pushing PNG away from the “business as usual” pre-PNG LNG case. It is also a remarkable contrast to the foreshadowed gains averaging 36% from PNG LNG partners.