Key points

The MYEFO foreshadowed a dramatic fall in expected revenues during 2016 of K1,866m. The Supplementary Budget sought to repair this revenue hole.

However, revenue in 2016 is likely to be K780m less than even predicted by MYEFO – so the actual revenue hole in 2016 is likely to total K2,666m (21% of the original revenue and grants forecast).

This additional revenue hole consists of a very likely additional shortfall in personal income taxes of K320m, a likely shortfall in company taxes of K400m, and a slightly more difficult to predict shortfall in GST revenues of K60m. Detailed analysis for these predictions are provided below.

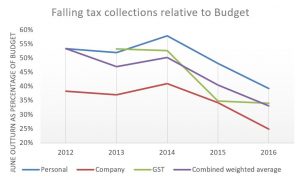

The basis of these predictions is the very low levels of actual collections in these three taxes up until June 2016 as shown in Graph 1 compared with previous years. Personal income taxes and GST are taxes that should remain relatively constant during a year. The usual forecasting expectation is that 50% of these taxes would be collected half way through the year. However, in 2016, by the end of June, collections were only 39% and 34% respectively. Company taxes are mainly collected towards the end of the year – about 38% in the first six months and 62% in the last six months of each year. However, by the end of June 2016, only 25% had been collected.

The MYEFO revised revenue forecasts down in part because of this low level of tax collection. However, this analysis indicates that they did not revise them down sufficiently according to economic theory and PNG’s own experiences.

Using a simple forecasting approach based entirely on collections would have led to more accurate predictions of final budget outcomes than MYEFO forecasts for these three taxes over the last four years.

The “Collections” methodology outlined below is simple. For example, half way through the year, half the personal income tax is likely to be collected. Last year, the PNG Treasury’s MYEFO revised its personal income tax forecast by taking the level of collections until the end of June, and then doubling this figure. In contrast, in this year’s MYEFO, the end of June tax collections where doubled, and then another 11.5 per cent added. This blog suggests that a better forecast is not to add the extra 11.5 per cent. This “add-on” is hard to justify, especially as it implies that nominal growth in wages will increase by 23 per cent over the next 6 months (as there is only half the year left to collect the extra revenue). Removing these “add-ons” across PNG’s three major taxes removes K780m from the updated revenue forecasts.

Further budget repair is required. This should be put in a medium-term context as PNG is already imposing tougher expenditure cuts than undertaken by Greece. Actual tax raising measures are also required. The long-term key is to improve diversified growth in the non-resource parts of the economy. Foreshadowed government policies in areas such as SMEs, agriculture and land, and current policies in areas such as its exchange rate, are undermining growth potential and hence sustainable budget repair.

Details

The original intent of this particular blog was to examine the growth implications of the fall in tax revenues shown in the PNG Treasury’s 2016 MYEFO. However, upon deeper examination, the drops in forecast revenues are too conservative. This blog will explain the basis for this claim, and the next blog will discuss the implications for growth of declining tax revenues in nominal terms.

The methodology is relatively simple. Three key taxes are examined in detail – personal income tax, company tax and the GST. These are PNG’s three largest single taxes. They account for nearly two-thirds of all expected revenue and grants in 2016 (63.7%). For revenue forecasting purposes, they are also the simplest to forecast. They are characterised by predictable patterns of collections. For personal income taxes and GST, the predicted pattern is of very even revenue collections throughout the year. Half way through the year, half the tax is likely to be collected. For example, last year, the PNG Treasury’s MYEFO revised its personal income tax forecast by taking the level of collections until the end of June (the June outturn), and then doubling this figure. This is the methodology used below called “Collections forecast” based solely on June outturns). In contrast, in this year’s MYEFO, the end of June tax collections where doubled, and then another 11.5 per cent added. This blog suggests that a better forecast is not to add the extra 11.5 per cent – especially as it implies that nominal growth in wages will increase by 23 per cent over the next 6 months (as there is only half the year left to collect the extra revenue).

For each of the three taxes, a table is presented below. This table sets out information from the last five years of MYEFO documents. Information is provided on the original budget, actual tax collections up to June (called the June outturn), this June outturn is then shown as a percentage of the original budget, the revised MYEFO forecast, and the actual outcome. Of course, there is no actual outcome yet for 2016 – this is the forecasting challenge.

The next line in each of the three tables introduces an alternative forecast to the MYEFO forecast. In line with the discussion above, this is a very simple alternative forecast. For personal income taxes and GST, the June collections outturn is simply doubled. Company income taxes are slightly more complex but also quite predictable. This is because the pattern of required tax payments by companies is mainly in the second half of the year. The pattern based on recent years is 38% of company taxes are paid in the first six months. This means the tax forecast is simply the June collections outturn increased by 2.63 times (the inverse of 38%). This forecast is called the “Collections” forecast.

The next two lines provides an assessment of the accuracy of the MYEFO revised forecasts to the simplified “Collections” methodology in predicting the actual outcomes. It shows the relevant forecast as a percentage of the actual outcome for 2012, 2013, 2014 and 2015. The number in the column on the right shows the average accuracy of the forecasts. For all three taxes, the simplified “Collections” methodology would have been more accurate than the actual MYEFO forecasts. For personal income taxes, the modified approach has an accuracy of 100.5% – so it slightly overestimates the actual outcomes. The MYEFO is less accurate at an average of 96.8% and it understates the revenue outcome – so the actual budget deficit ends up being larger than expected.

For company taxes, the “Collections” methodology has an average accuracy of 101.4%, slightly better than the 102.9% of MYEFO. On the GST, the “Collections” methodology is once again more accurate than MYEFO forecasting, with a 97.5% accuracy relative to an average of 89.1% for MYEFO.

The overall implications for this analysis is shown in the final line “2016 Forecast Revenue Gap”. This is the difference between the “Collections” methodology for 2016 and the current 2016 MYEFO forecasts (which were significantly revised down from the budget). The gap is K319.2m for personal income taxes, K400.8m for company tax, and K60m for GST – a total of K780m.

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | Average Accuracy 2012 to 2015 |

| Personal | ||||||

| Budget | 2417.4 | 2608.0 | 2852.0 | 3303.1 | 3511.7 | |

| June Outturn | 1288.3 | 1355.2 | 1651.9 | 1589.2 | 1379.1 | |

| Outturn to Budget | 53% | 52% | 58% | 48% | 39% | |

| MYEFO | 2471.4 | 2740.4 | 2924.0 | 3178.4 | 3077.4 | |

| Outcome | 2648.7 | 2808.4 | 3195.1 | 3037.1 | ||

| “Collections” forecast | 2576.6 | 2710.4 | 3303.8 | 3178.4 | 2758.2 | |

| “Collections” forecast to Outcome | 97.3% | 96.5% | 103.4% | 104.7% | 100.5% | |

| MYEFO to Outcome | 93.3% | 97.6% | 91.5% | 104.7% | 96.8% | |

| 2016 Forecast Revenue Gap | 319.2 | |||||

| Company tax | ||||||

| Budget | 1692.1 | 1891.5 | 2674.4 | 2746.1 | 2793.2 | |

| June Outturn | 647.2 | 700.6 | 1094.4 | 941.2 | 695.2 | |

| Outturn to Budget | 38% | 37% | 41% | 34% | 25% | |

| MYEFO | 1762.1 | 1911.6 | 2704.1 | 2622.5 | 2230.3 | |

| Outcome | 1744.5 | 2060.5 | 2522.4 | 2374.8 | ||

| “Collections” forecast with average 38% payment to June | 1703.2 | 1843.7 | 2880.0 | 2476.8 | 1829.5 | |

| “Collections” forecast to Outcome | 97.6% | 89.5% | 114.2% | 104.3% | 101.4% | |

| MYEFO to Outcome | 101.0% | 92.8% | 107.2% | 110.4% | 102.9% | |

| 2016 Forecast Revenue Gap | 400.8 | |||||

| GST | ||||||

| Budget | 545.3 | 954.4 | 1181.4 | 1366.8 | 1218 | |

| June Outturn | 550.0 | 507.7 | 622.0 | 476.0 | 415 | |

| Outturn to Budget | 101% | 53% | 53% | 35% | 34% | |

| MYEFO | 762.9 | 1058.6 | 1199.4 | 956.0 | 890 | |

| Outcome | 1010.0 | 1217.2 | 1042.0 | 1214.0 | ||

| “Collections” forecast | 1100.0 | 1015.4 | 1244.0 | 952.0 | 830 | |

| “Collections” forecast to Outcome | 108.9% | 83.4% | 119.4% | 78.4% | 97.5% | |

| MYEFO to Outcome | 75.5% | 87.0% | 115.1% | 78.7% | 89.1% | |

| 2016 Forecast Revenue Gap | 60.0 | |||||

| Total 2016 Forecast Revenue Gap | 780.0 |

PS The author has some background in revenue forecasting in the Australian Treasury. He headed the Tax Analysis Division which did all revenue forecasting for the Australian Government through 2006 and 2007. He co-chaired with the Department of Finance the secretariat in charge of checking the accuracy of revenue and expenditure costings for the 2007 federal election. He began work on revenue forecasting as part of the 1985 tax reforms put forward in the draft white paper. He headed Treasury’s Strategic Tax area from 2002 to 2006. He was in charge of the Henry Tax Review Secretariat areas responsible for capital and resource taxation before being promoted to deal with international finance and development issues in 2008. He is well aware of the limits of forecasting methodology. A key lesson learnt is to use a simple methodology if possible.