Executive Summary

- PNG’s revenue collapse is likely to continue with estimated additional shortfalls of K1.5 billion for both 2016 and 2017. This will add to the budget deficit, debt levels and financing pressures.

- The major reason for this collapse in revenues is not the fall in international commodity prices

- The reason is the fall in domestic tax collections as a result of PNG’s domestic recession.

- There have already been enough expenditure cuts in key sectors between 2015 and 2017 (a 52% real cut in infrastructure, 45% in education and 40% in health with large on-going cuts already planned in future years).

- Better policies are needed to restart growth and additional tax measures should be considered.

- The major reason for this collapse in revenues is not the fall in international commodity prices

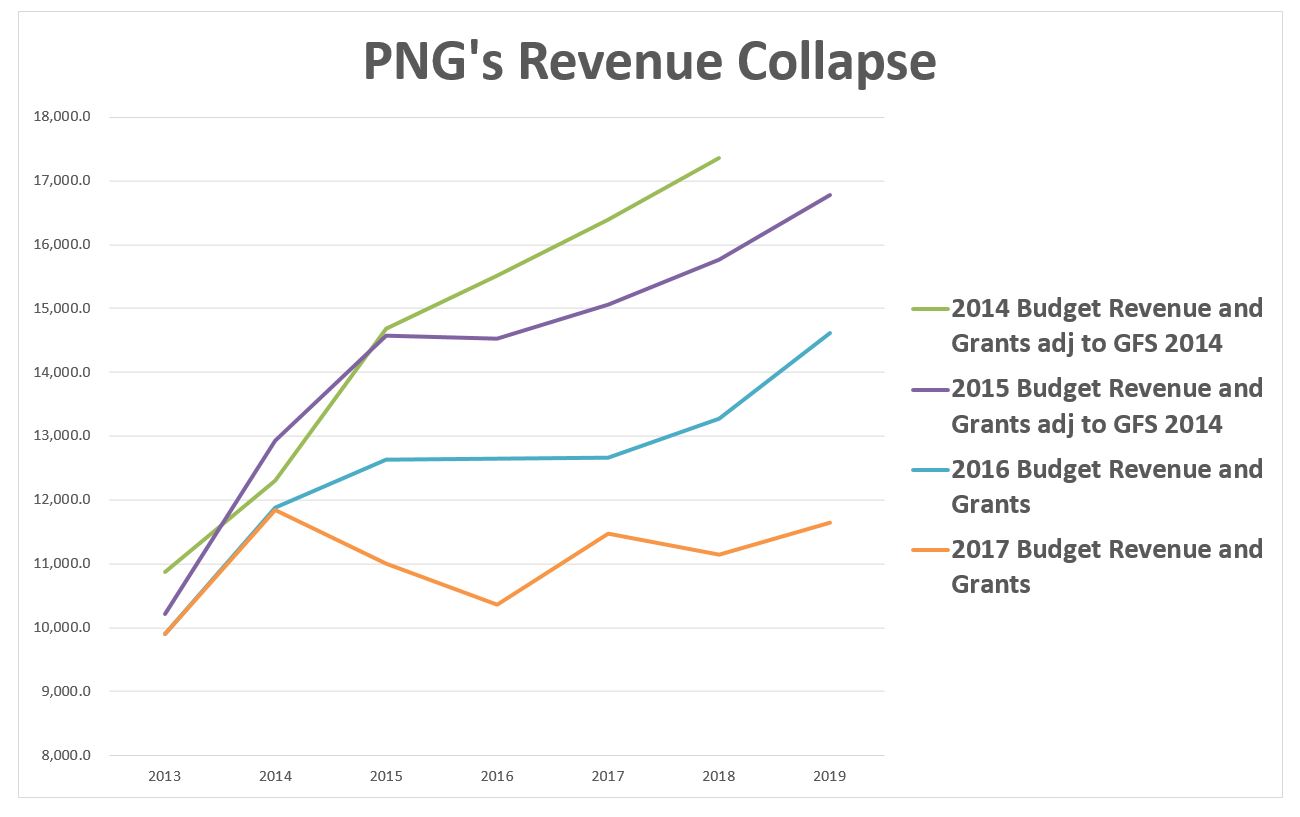

- In 2014, it was forecast that 2017 PNG revenues (so excluding international grants and after adjusting for accounting changes) would total K15.2 billion. This has fallen in each subsequent budget (the falling lines shown in the figure below) so that by the time of the 2017 budget these were K4.7 billion lower than initially forecast – a drop of 31%.

- And if we look at 2018 figures the fall is K6.3 billion or 38% from expectations of 2014.

- The fall in revenues has gone through several phases.

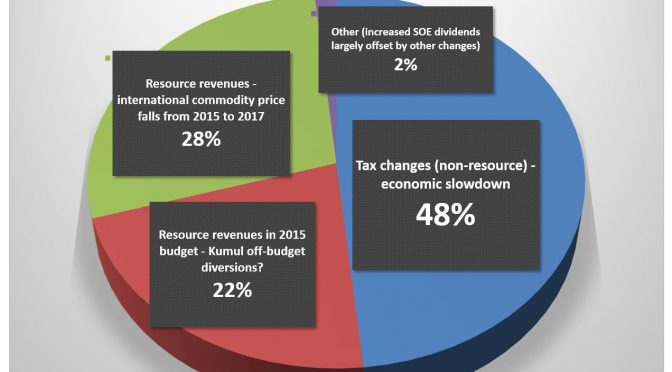

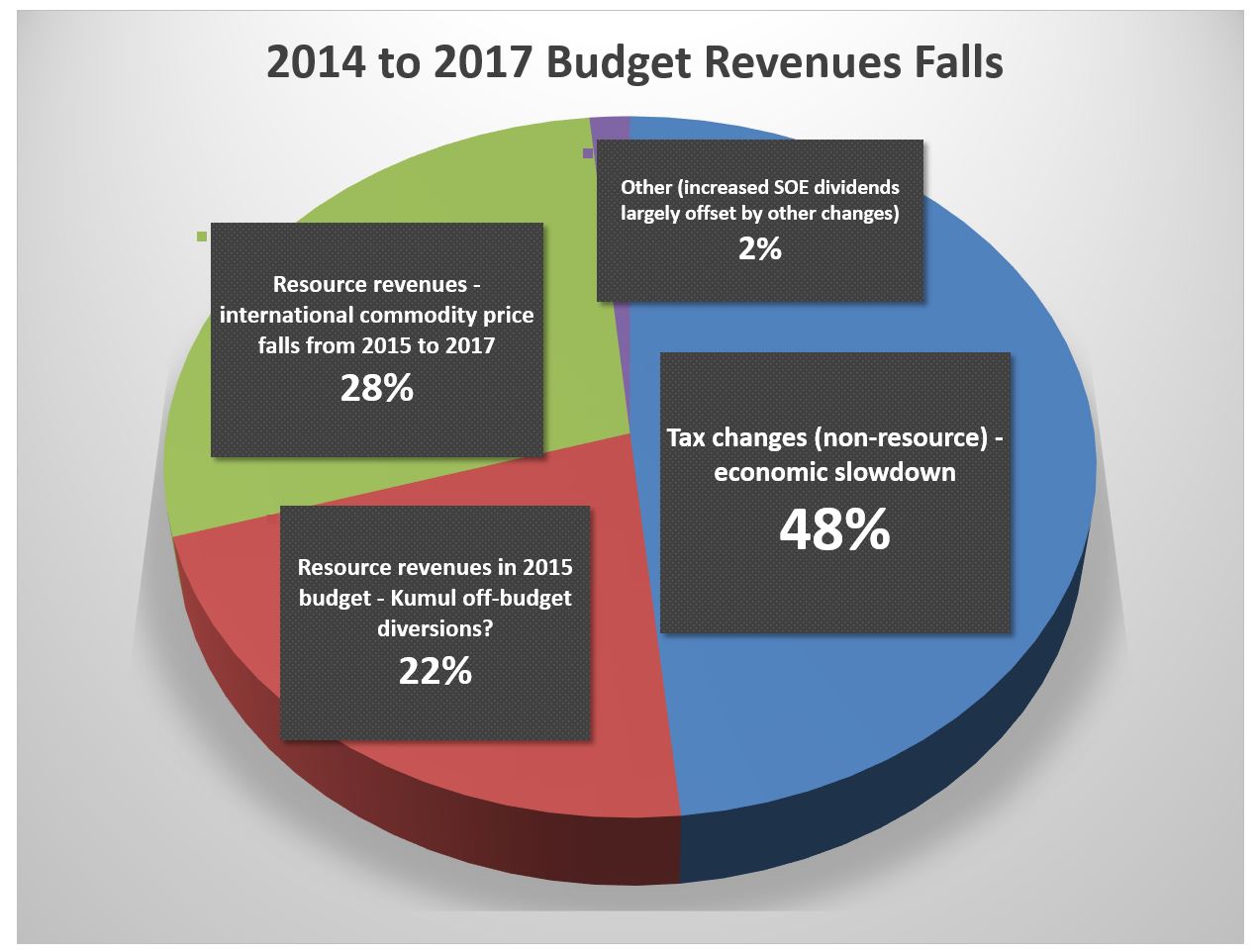

- The 2015 budget removed K3.3 billion in resource revenues even prior to the fall in commodity prices. This is the K3.3 billion “missing revenues” referred to in the much condemned but broadly accurate blog (see here) predicting the fall in oil prices would hurt revenues and the balance of payments. This early diversion accounts for 22% of the total revenue fall.

- The 2016 budget included most of the impacts of the fall in international commodity prices – this remaining fall in resource taxes and dividends accounts for 28% of the total revenue fall.

- The 2016 budget also showed a major fall in domestic taxes – indeed, the relevant 2015 MYEFO showed these were even larger than the additional falls in resource revenues.

- This fall in domestic taxes continued into the 2017 budget.

- The major reason for the fall in revenues has been slower growth in the PNG economy – indeed a domestic recession in non-resource GDP after the end of the PNG LNG investment phase – see here and here.

- Company tax collections are estimated to be K979m lower, GST K610m lower and personal income taxes K408m lower in 2017 relative to 2014 forecasts.

- This fall in domestic taxes, reflecting negative real economic growth, accounts for 48% of the fall in estimated 2017 revenues since the 2014 budget (see pie chart below)

- PNG’s Treasury has moved to a pattern of significantly over-estimating revenue forecasts

- Based on figures from 2013, the average forecast shortfalls in PNG revenues (excluding international grants) has been K1,424 million in the actual budget year

- rising to K3,256m two years from the budget (26% of average revenue forecasts)

- As PNG’s growth prospects are still very uncertain, and given the patterns of oversell in recent budgets, this shortfall may also occur again in the 2017 revenue forecasts.

- The 2016 forecast already includes a non-revenue item for K725m from the sale of the currently off-budget PNG LNG assets held in Kroton

- Using the same simplified methodology for analysing the MYEFO here, the three main tax sources of personal income tax, company tax and GST for 2016 are estimated to be K750m lower than the figures included in the 2017 budget (this is even after using the GFS 2014 version of GST ie including provincial allocations).

- Together, this implies 2016 revenues are likely to be K1.475 billion lower than included in the 2017 budget.

- For 2017, the K750m lower tax base will flow through the forward estimates. The compliance dividend of K400m is very unlikely-a reasonable assumption may be K100m. Forecast dividend payments of K1,075m are unlikely – a figure closer to 2016 estimates of K616m is more realistic (noting the forecast for 2018 is only K80m). Together, this implies 2017 revenues are likely to be some K1,508m lower than forecast in the 2017 budget (almost exactly in line with the pattern of over-estimates for the last four years).

- Beyond 2018, the gap between the forecasts and likely outcomes is expected to drop quickly. In particular, the forecast of no dividend payments from the PNG LNG project from 2018 onwards is extraordinary (unless the funds are being held in Kumul Petroleum for other purposes).

- Lower domestic revenues in 2016 and 2017 will increase deficits and build up debt levels. Given the difficulties of domestic financing, and little scope to do more on the expenditure or revenue sides prior to the mid-2017 election, there is now even greater pressure on getting international financing

- The Sovereign Bond appears to be effectively dead.

- The Credit Suisse $US200m tranche will assist but its costs should be made public – especially before any further tranches are drawn down

- PNG’s credit rating will remain under significant downward pressure.

- PNG needs to move to better pro-growth policies to fix the budget and possibly consider other tax measures to help fill the budget gap

- such as a capital gains tax suggested in the recent PNG tax review by Sir Nagora Bogan

- too much emphasis has been placed on cutting expenditures in key sectors such as health, education and infrastructure (and not enough on administrative costs or constituency funds).

- Based on figures from 2013, the average forecast shortfalls in PNG revenues (excluding international grants) has been K1,424 million in the actual budget year

Figures

More details of this analysis are available through the commercial/subscriber elements of this website (contact admin@pngeconomics.org).