PNG’s 2017 budget was a key opportunity to demonstrate the credibility of the government’s economic management before next year’s election. It fails.

Foolish games with numbers and unrealistic assumptions severely undermine the budget’s credibility (detailed examples on the revenue and expenditure side are provided below). Indeed, the level of deception arguably approaches fraud – an intention to gain advantage either politically or from investors.

A major winner from the budget are overseas petroleum shareholders with proposed cuts in the company tax rate from 45% (new fields) or 50% (old fields) down to 30%. This will be of particular joy to Oil Search and others that will gain from a new possible Papua LNG project – but they are possibly accessing the lower rate for condensate already. PNG’s tax regime for the petroleum sector was already considered generous relative to world standards – it now will be even more so. And although some of the changes mirror suggestions in the Sir Nagora Bogan tax review, off-setting elements such as the introduction of a capital gains tax and reduced tax incentives are not mentioned in the budget changes. Overall though, the standardisation of rates, and mild action to increase revenues in some other areas, are welcome.

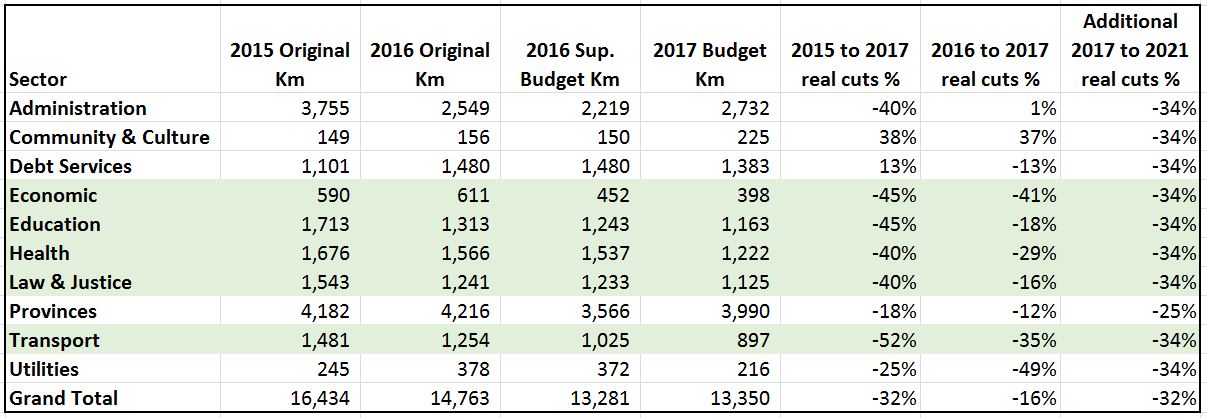

Concessions to the petroleum sector and only moderate tax increases represent interesting choices for a government given the announcement of major cuts in key areas such as health, education and infrastructure. The future expenditure cut pain is also severe with further foreshadowed cuts of 34% in real terms from 2017 to 2021 except for Provinces with “only” a 25% cut. Even from the 2016 budget, the cuts are very large. Going against this trend of massive cuts, and in part reflecting the needed priority on the election (K400m) but also the more optional K250m for APEC in 2017, the administrative and “community and culture” areas are the only sectors that grow in real terms between the original 2016 budget and the 2017 budget. As shown in the table below, in stark contrast to the government’s claimed priorities, the real cuts to health are 29%, to education are 18% and to transport are 35%. No wonder most of the expenditure reduction figures shown in the budget “spin” documents only express the cuts relative to the 2016 revised budget. This ignores the major expenditure reductions made between the 2016 budget and the revised 2016 budget flowing from the collapse in domestic revenues. This is at best convenient. (The sectors of key government priority are shaded in green – they are generally the ones with the largest cuts – all of them incurring greater cuts than the average cut shown in the final row on totals).

Of course, key election elements are protected. For example, K20m is still provided to fund the “free health” policy. This represents less than 2% of the total health budget and is minuscule relative to the K315m cut in health in this 2017 budget. The K20m “free health” policy is a smokescreen for the major cutbacks in health that are hurting church services and the level of assistance provided by health centres. There is essentially no mechanism for distributing these funds down to rural clinics – so simply banning the collection of any fees means that these clinics are forced to operate without basic medicines or to close down altogether. “Free health” becomes “No health”.

Following are some examples that severely damage the credibility of the budget. There is a systematic pattern of choosing numbers to fit the budget’s key claimed theme of “Responsible Fiscal Consolidation”. My earlier blogs on the 2015 and 2016 budgets have highlighted a range of errors in the budget numbers. These were usually clumsy, accidental, or appearing to mainly reflect errors. However, there is an underlying pattern of distorting usual budget forecasting methodologies, not present in previous budgets, that makes it hard to conclude other than that the assumptions are driven to deceive. The gain from the deception is potentially electoral and investment credibility and gain. Calculated deception for gain amounts to fraud in usual understandings of the term. This is a budget that should not be trusted. Some more details on the factors that undermine the budget’s credibility are provided below.

On the revenue side, the budget assumes that an extra K16 million for the Internal Revenue Commission will magically produce a K400 million increase in revenue – all in 2017. Increased resourcing to the IRC should help increase revenues, but it has not helped over the last two years despite more and better paid staff.

- The practicalities of needing to go through additional recruitment and training of new staff are ignored. Such a pay-off figure of K1 extra in IRC resources producing an extra K25 in revenue is unrealistic – the figures used by tax agencies is more usually in the range of 5 or 8 to one over time, not 25 to one.

- Company tax levels are expected to increase from an estimated K2,305m in 2016 to K3,322m in 2021. This 44% increase just does not seem credible – and it is a vital K1 billion assumption in closing the budget deficit hole.

- Meanwhile, there are major revenue holes that appear in the budget that are very difficult to explain. In the 2016 revised budget, there is K725m shown as payments into the SWF from the “sale of shares” (Table 14 in Appendix 3). This is a surprise as there appears no public announcement of that sale having been completed. In accounting terms, this is simply swapping on capital asset for cash – it should be shown as a ‘below the line’ transaction which should not affect the deficit – it just lowers the off budget assets of Kumul Petroleum Holdings – and this may have implications for other debt held against these off-budget assets.

- Meanwhile, Kumul is paying no dividends through the PNG Sovereign Wealth Fund. The SWF is effectively dead and certainly the Savings Fund is projected to have no assets going forward.

On the expenditure side, from 2017, there is a straight cut of 11 per cent in nominal terms, and 34 per cent in real terms after allowing for inflation, in all sectors other than provinces. This is not a credible approach.

- The impossible claim is that debt servicing interest costs will fall from K1,480m in the revised 2016 budget down to K1,393m in 2017, and then down to K1,290m in 2019.

- This is just not possible given growing nominal debt levels and the increasing costs of moving the debt portfolio to longer terms (there has been a major reliance on short-term funds to finance the massive increases in government debt – this has distorted debt portfolio planning and the government is intending to move to higher priced but longer term debt to reduce the increasingly high risk of debt rollover default ).

- At least in the 2016 budget, where smaller deficits were predicted through to 2019, it had the sense to admit that interest costs were likely to rise to K1,553.6m by 2019 (compare the figures in Table 12 of both budgets).

- Once again, this type of game, despite increasing debt levels, which produces K263m to close the budget deficit, appears to be deliberate and simply deceptive.

- The flat cut of 34% in real terms to all sectors other than Provinces also indicates a severe lack of forward planning and budgeting systems. This level of reduction is well above what can be obtained through usual “efficiency dividend” numbers of 2 or so percent per year where sometimes all departments face a similar cut. This will have to severely cut into departmental programs and staff numbers.

- Numbers appear to have been arbitrarily chosen to produce the desired reduction in the deficit and to control debt levels. The “assumed” cuts from 2017 to 2021 are worth over K4 billion – this is where all the work is being done to cut the deficit and cut debt levels (Table 12 – 2017 expenditure of K13,350m, 2021 nominal expenditure of K12,462m or K9,133m after allowing for forecast inflation of 7%, 6.6%, 5.6% and 5.2% during the four years – so a cut of K4,217m in 2017 Kina terms).

The financing for the budget deficits also do not seem to be fully considered.

- For example, Table 10 Appendix 3 still indicates for the 2016 revised budget K2,800m in extraordinary financing. This is the value of the Sovereign Bond that was assumed in the 2016 but has not been delivered – and is unlikely to be delivered by the end of the year.

- As noted above, it is also assumed that the PNG LNG shares are sold by the end of the year for K725m.

- These are key sources of financing given the difficulties of accessing domestic bond markets. There may be a cash flow crunch around the corner if these assumptions do not occur. The Credit Suisse funding does not get close to filling this looming cash crunch hole.

Overall, it is important to map out a course to return to fiscal sustainability. The massive deficits entered into in 2013 and 2014 were a huge gamble, and the fall in commodity prices means the gamble did not pay off. However, fiscal policy must be credible. There are too many at best errors, but more likely deliberate manipulations in this budget to restore credibility in PNG’s economic management.The best way to fix the budget is encouraging higher domestic economic growth.However, poor policy choices in areas covered in other blogs such as the exchange rate and policies that are likely to undermine growth (SME, land, agriculture). The best option for fixing the budget, stronger rates of broad-based growth, is unlikely.