Overview

PNG’s new Treasurer and DPM, Charles Abel, has released the promised 100 Day Economic Stimulus Plan (see here). Overall, there are some positives in the plan. But politics is already circumscribing necessary actions to get PNG back onto the right economic path.

Starting with the positives, even having a 25 point plan is a useful statement that the new government recognises PNG’s economic challenges. The five elements of the plan are appropriate: fiscal discipline; revenue growth; strengthening the economic base; improving governance; and acting strategically. There is a focus on raising revenues as well as fiscal discipline. Population policy is given priority. The plan announces the suspension and review of some scary micro-economic policies in areas such as land, agriculture, bio-security and mining. Some politically brave action is foreshadowed to at least temporarily reduce politicians’ discretionary electorate spending (PSIPs and DSIPs). There seems a commitment to on-going sensible strategic budgetary and planning processes. There is no mention of the absurd “gold bullion bank” in the Alotau Accord 2.

Unfortunately, the plan does not appropriately address the challenges and opportunities facing PNG (see here). Fundamentally, there is no shift towards more broad-based development. The ‘economic base’ section is a disappointing mix of known resource and power project prospects and aid programs.

Even in assessing the Supplementary Budget, there is a missing K2.7 billion in public debt repair required that is not explained. PNG’s foreign exchange difficulties are misrepresented as rice and fuel are not the biggest drains on foreign exchange. More will need to be done on the revenue side than is currently being revealed by the government.

Conclusion

I want to stay positive and to give the new Treasurer a fair go. There are some positives in the plan. But there is a sense of a Sir Humphrey Appleby in the PMO thwarting the new Treasurer’s aspirations. A one page sheet released 4 weeks into government dominated by a continuation of existing policies/projects/announcements and inaccurate spin in not a great plan. The Supplementary Budget, the 30 September Monetary Policy Statement and the 2018 Budget will hopefully provide a better benchmark for assessing whether the government has actually learnt from its economic mistakes of the last 5 years.

Details

Because the comments above about the missing K2.7 billion in debt repair and misrepresenting the foreign exchange situation are likely to attract greatest attention, I will deal with these two issues first before covering some other elements of the plan.

The fiscal challenge is impossibly presented in the first point of the plan concerning the Supplementary Budget. It states the 2017 Supplementary Budget will achieve the legislated 30% debt ratio target. This is just not possible given the deficit target. The maths, using the 2017 MYEFO as the benchmark – see here Tables 1, 2 and 18 – is the government will try and reduce the size of the fiscal deficit by 1.3% of GDP (from 3.8% in the 2017 MYEFO forecast to 2.5%). This will reduce public debt levels by a similar amount as the government will no longer need to borrow to cover the reduced deficit. So the expected 2017 public debt ratio will reduce by 1.3% of GDP from the MYEFO forecast of 34.9% to 33.6% of GDP. That is K2.7 billion higher than the claimed target in the opening point of the 100 day plan (3.6% of the K74.2bn MYEFO estimate for GDP). The only ways to achieve the target would be for a massive unannounced K2.7 billion in asset sales, moving K2.7 billion in public debt off the books and into hiding, or having an explosion in the GDP growth rate in the next 4 months. There are better ways to build confidence in economic management than such an error.

Another example of inaccuracies is the Treasurer’s statement that “Imports of fuel and rice are the greatest consumers of foreign exchange”. By mis-stating the nature of PNG’s foreign exchange challenges, there is little hope that the issue will actually be addressed. Releasing $US100m in foreign exchange reserves does not deal with the underlying problems. Specifically, according to BPNG (Table 8.6 of the Quarterly Economic Bulletin Statistics – see here), PNG’s total imports of food and live animals totaled K527.9m in 2016. This is already half the level of K1,119.1m in 2011. PNG’s imports of food and live animals is only a quarter of the largest good import category of “Miscellaneous manufactured articles” of K2,196m and half the second largest item of “Machinery and transport equipment” of K1,374m. Possibly the issue is in the more detailed classification of particular sub-categories of goods – but this is starting to miss the big picture that the largest consumer of foreign exchange is actually related to imports of items such as cars and consumer goods. And checking on the more detailed information on Australian trade with PNG (see here for pdf), going through the list of PNG’s imports from Australia, the four large goods items are ‘Crude petroleum’, ‘meat (exc beef)’, ‘civil engineering equipment and parts’, and ‘wheat’.

Rice doesn’t even make the list.

And the fuel imports are a tricky issue of ins and outs, for although PNG imports lots of particular kinds of fuel, it also exports lots of particular kinds of fuel. So in the case of Australia, PNG imports $A151m of crude petroleum products, but it also exports to Australia $A559m in crude petroleum products. Diverting fuel exports into local consumption does nothing to improve the balance of payments – the reduction in imports exactly matches the reduction in exports.

I have long believed PNG’s agriculture sector is its real strength and have never understood why I couldn’t buy good local bananas in the local Port Moresby supermarkets but could find them not far out of town. And meat from the Sogeri plateau is excellent. More can be done. But to simply focus on rice imports? If one was cynical, concerns could be expressed about the possible influence of a suspected Indonesian fugitive. There is still too much politics (and possibly corrupt politics) in this document and not enough economic sense based on the facts.

Arguably, the greatest weakness of the plan is the failure to articulate a new, more inclusive economic vision for PNG. The section on “Strengthening Our Economic Base” starts with a list of well known resource prospects, then some Australian aid projects (!), then power project prospects that have been around for years followed by some previously announced “high impact projects” (submarine cable, PMIZ). There is no mention of cultural diversity, tourism or the forest sector (yet alone biodiversity) where PNG is in fact a world leader. There are no initiatives to try and reduce red tape and improve business regulation to provide a better environment for SMEs. There is little for women’s economic empowerment or the rural poor. The development path remains focused on resource projects and other ‘big project’ ideas that seem to do well for proponents but not for inclusive growth.

As mentioned earlier, one of the strengths of this document is the attention being given to “Growing Our Revenues“. There are some positive actions but implementation is a key. PNG Treasury documents have long stated that revenues collected by non-tax revenue agencies should flow into the Consolidated Revenue Fund. However, this is largely ignored by agencies with little consequence for their budgets. The big issue here is Kumul Petroleum. There is simply not enough transparency to know how much of their dividend collections are actually committed to various loans and other ventures.

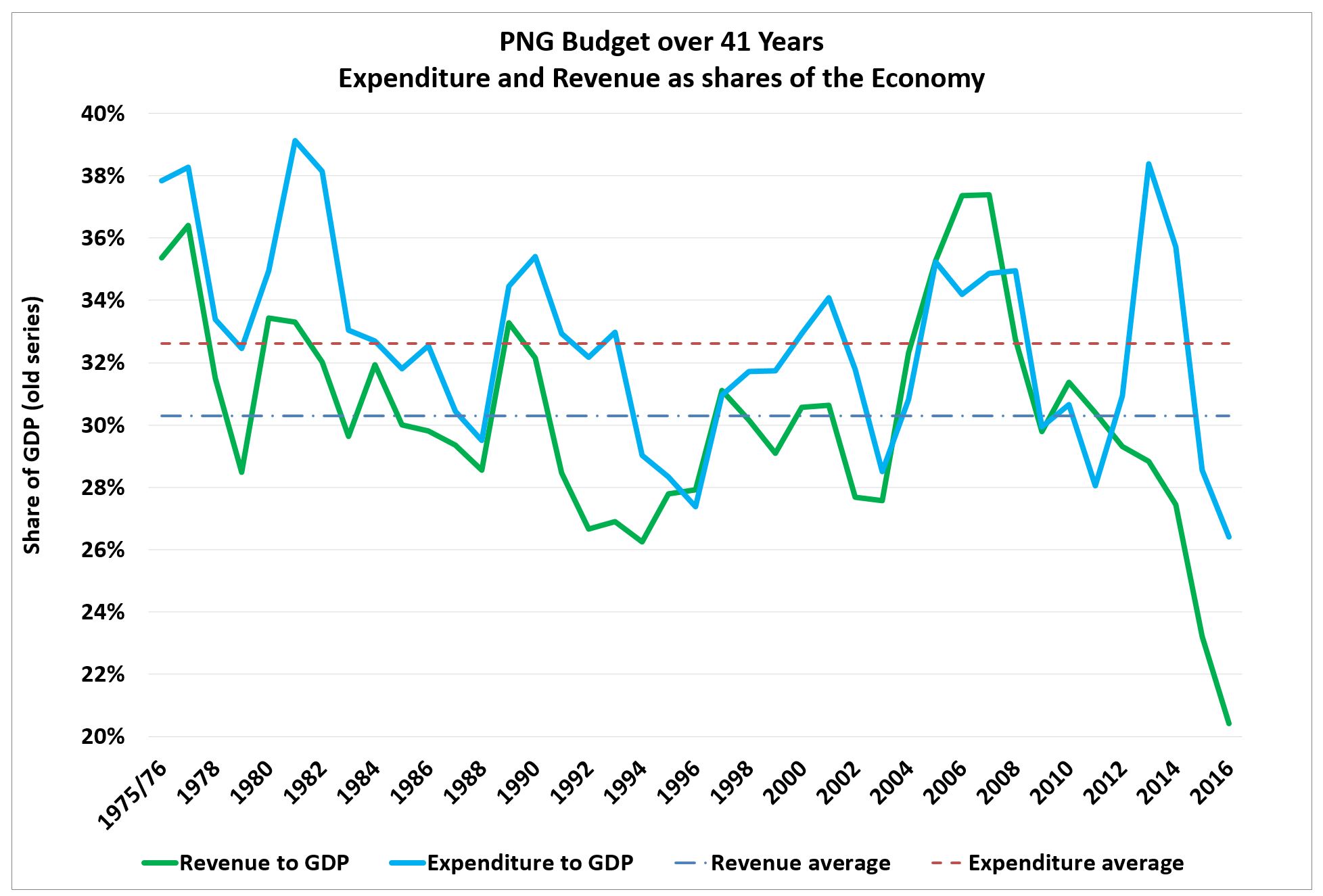

Another key issue is whether enough can be done through administrative action to lift PNG’s revenues to the levels required given the “big state” ambitions of PNG. Action on tax compliance has been a feature over many budgets. There are gains, but these tend to be incremental and relatively small relative to the challenge of PNG’s revenue collapse to its lowest levels ever as a share of GDP – see green line in graph below.

A future article will cover the inevitable need to raise tax levels (and possibly introduce new taxes) drawing on the Sir Nagora Bogan tax review previously commissioned by the government.

The elements of the “Improving Our Governance Record” are positive although it remains to be seen if some big donors such as China will untie their loans. SOE and Statutory Authority audited accounts would be good – but why do we have to wait nearly a year? There is information available that should be released to improve transparency. However, overall this section seems to miss the big picture around corruption – so there is no mention of an ICAC.